Dmv sales tax calculator

Enter the values below and click Calculate. The supported browsers are Google Chrome Mozilla Firefox Microsoft Edge and.

Calculate My Fees California Dmv

Effective July 1 2016 unless exempted under Va.

. If the vehicle was a gift or was purchased from a family. California has a 6 statewide sales tax rate but also. If you leased the vehicle see register a leased vehicle.

A Purchase and Use Tax Computation - Leased Vehicle Form form VD-147 may be submitted in lieu of a copy of the lease agreement and dealer worksheet. Title Ad Valorem Tax TAVT became effective on March 1 2013. Original Acquisition Cost - Lease.

Multiply the rate by the purchase price to calculate the sales tax amount. North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle.

The DMV calculates and collects the sales tax and issues a sales tax receipt. Interactive Tax Map Unlimited Use. After 1 is retained by the County Treasurer and 1 is distributed to the V ehicle Title and Registration System.

Ad Lookup Sales Tax Rates For Free. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Code 581-2402 Virginia levies a 415 Motor Vehicle Sales and Use SUT Tax based on the vehicles gross sales price or 75 whichever is.

The online estimates DOES NOT include the sales tax. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The distribution of funds collected for the Motor Vehicle Tax are.

TAVT is a one. All applicable sales andor use taxes must be paid before the Department or any county clerk acting as the Departments authorized agent may issue a certificate of title. The tax must be paid at the.

Vehicles are also subject to. Motor Vehicle Trailer ATV and Watercraft Tax Calculator. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local.

Department of Motor Vehicles. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle. Find out how much tax you can expect to pay for your new car.

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive. This tax is based on the value of the vehicle. Note that sales tax due may be adjusted and payment will be required if the amount entered is incorrect and not.

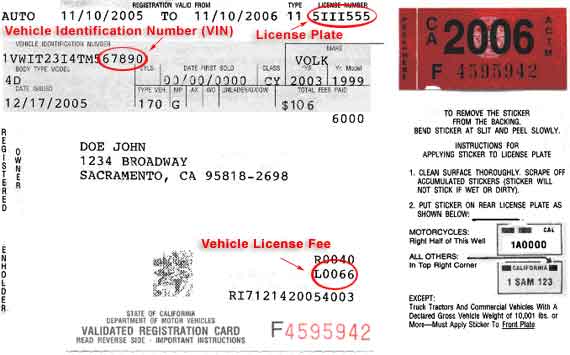

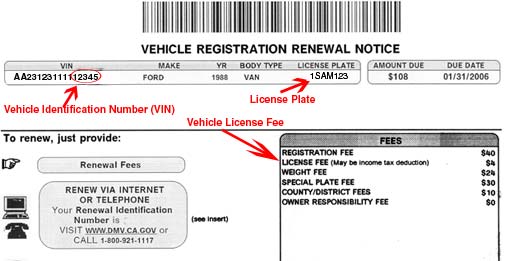

You can also use these charts to estimate your registration fees use taxes and supplemental fees for. The browser you are using is not supported for the DC DMV Online Services. Plus additional title and registration fees.

Calculate State Sales Tax.

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Car Tax By State Usa Manual Car Sales Tax Calculator

Florida Vehicle Sales Tax Fees Calculator

Vehicle Registration Licensing Fee Calculators California Dmv

Vehicle Registration Licensing Fee Calculators California Dmv

Car Tax By State Usa Manual Car Sales Tax Calculator

California Vehicle Sales Tax Fees Calculator

California Used Car Sales Tax Fees 2020 Everquote

Dmv Fees By State Usa Manual Car Registration Calculator

How Does Vehicle Registration In California Work Tax Wise Quora

Vehicle Registration Licensing Fee Calculators California Dmv

Virginia Vehicle Sales Tax Fees Calculator

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Vehicle Registration Licensing Fee Calculators California Dmv

2

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price

Vehicle Registration Licensing Fee Calculators California Dmv